PDF editing your way

Complete or edit your 940 form 2021 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 940 form 2020 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 940 for 2021 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2020 form 940 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Tax 940

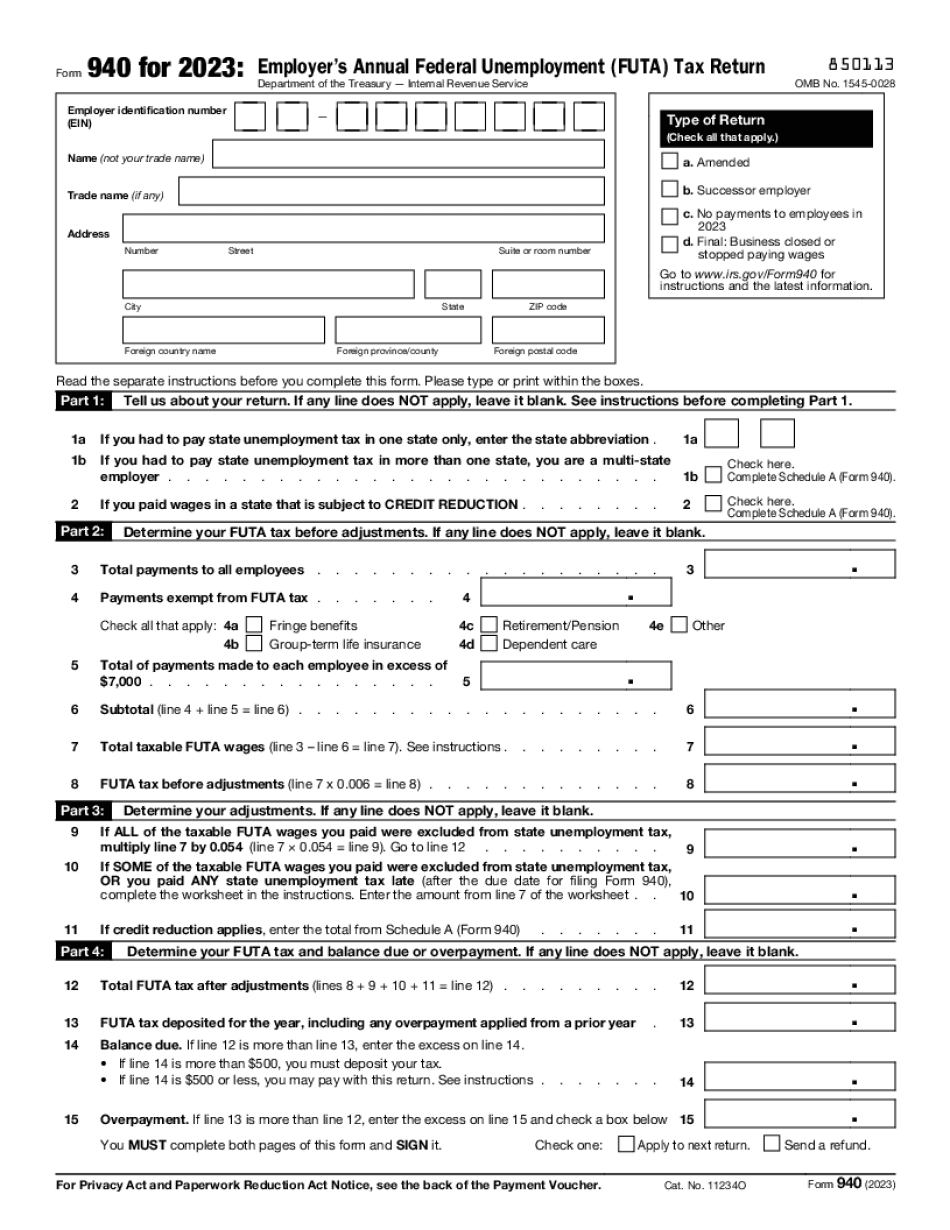

What Is Form 940?

Use an online fillable and editable Irs 940 Form to report your annual Federal Unemployment Tax Act (Futa) tax. Now it's easy both to download a template and complete it by hand or fill out a digital blank in the PDF format.

940 Form is a document necessary to be prepared by employers by the end of a calendar year.

You have to complete it if:

- You paid $1500 and more to employees.

- You had one or several temporary workers in any 20 weeks of the past two years.

The paper is supposed to calculate the employer’s federal unemployment tax liability, adjust for state taxes paid and calculate the their due. The document compares the tax due for the year to the already paid. You have to pay the underpaid amount.

The 940 Form has to be submitted by January, 31.

Open the blank and read all the field labels. Then start filling out the lines according to the following guideline:

- Part 1 of the sheet contains three sections. The first one requires the information about your state and whether you had to pay fees only in one. The second section is necessary if you are a multi-state employer. You have to list each state, a reduction rate, the credit reduction and a total credit reduction. Complete Schedule A if you paid to employees in a state subjected to credit reduction.

- Part 2 indicates your Futa tax before adjustments. Prdetails pertaining all the payments made.

- Part 3 of the document calculates adjustments including credit reductions.

- Part 4 calculates the balance due or underpayments.

- Then it comes to reporting your tax liability by quarter (required if the yearly amount is more than $500)

- The next part has to include information from a third party (i.e. someone who is cognizant in your business).

- Add your signature in Part 7. You may do it by typing, drawing or uploading a signature from any internet-connected device.

Before signing check all the detail provided. Then send the completed IRS 940 Form via email, fax or even sms.

Online methods assist you to prepare your doc management and raise the efficiency of one's workflow. Abide by the short manual as a way to complete Form Tax 940, stay clear of errors and furnish it inside a well timed method:

How to finish a Irs Form 940?

- On the web site along with the sort, click on Commence Now and go to your editor.

- Use the clues to fill out the pertinent fields.

- Include your individual facts and speak to data.

- Make guaranteed you enter correct facts and quantities in best suited fields.

- Carefully take a look at the content in the form at the same time as grammar and spelling.

- Refer that can help segment when you've got any doubts or handle our Support workforce.

- Put an digital signature on your own Form Tax 940 while using the guide of Indicator Instrument.

- Once the shape is concluded, push Performed.

- Distribute the ready kind by using e-mail or fax, print it out or save with your machine.

PDF editor enables you to make changes with your Form Tax 940 from any world-wide-web linked product, customize it as per your requirements, indicator it electronically and distribute in different options.